When Network Effects Lose Their Armor

Part-I: Ride Sharing Networks

Part-I: Ride Sharing Networks

There are many good pieces about network effects. Arguably, “All about Network Effects” by Anu Hariharan and “Network Effects and Critical Mass” by Tren Griffin, are among the best.

But, in short, what are network effects?

A product displays positive network effects when more usage of the product by any user increases the product’s value for other users (and sometimes all users) - NYU

The key benefit is to:

Create barriers to exit to existing users and barriers to entry for new companies - Anu Hariharan

In this article, spread across multiple posts, I will share a perspective about the influence technological changes could have on some of the current businesses with strong network effects. To evaluate the impact, we will look at examples from different domains. Each vertical will be covered in a separate post.

In part-I, we will explore the case of ride sharing networks.

The first companies that come to mind are, evidently, Uber and Lyft. They’re the two dominant players in the US and no new entrant has managed to take a relevant part of their business. Factors such as, access to large sums of capital, the ability to handle battles with regulators and their overall execution excellence have played an important role in their success. Nonetheless, what keeps fueling their growth and preventing more competition, are the network effects that kicked-in, after those companies reached a critical mass.

The more drivers join, the better the service gets for riders, and the more riders use it, the better the earnings get for drivers. Those network effects are even stronger within the pooling service. The more riders accept to pool, the more valuable the service becomes for both other riders and drivers.

That has been the major competitive advantage of Uber and Lyft till now. Nowadays, the software part is not hard to replicate. But, growing a new service to the point where it is as valuable as the existing ones is extremely difficult.

Something, seemingly mundane but actually interesting, is happening though. In the Bay Area, many drivers have both Uber and Lyft logos on their cars. Similarly, users have both Apps and would switch between the services depending on the rates and current offers.

It seems that once an alternative service emerges, customers are ready to cross borders from one network to another without any brand loyalty. Nevertheless, there is still a protective limitation coming from human capacity. Hardcore drivers may have 3 or 4 phones on the dashboard. But, in most countries, almost no one would have 10.

Places like Hong Kong, where this driver has 13 phones, are among the exceptions.

Even for Hong Kong though that’s a rare case. Drivers there usually have 3 to 6 devices to handle various dispatch services.

What’s fascinating about the 13 phones example, is it gives an outlook on the future of what people want.

In the sense that people want to participate in as many networks as they can in order to maximize their gains. They’re only limited by the availability of relevant networks and their human ability to use all of them at the same time.

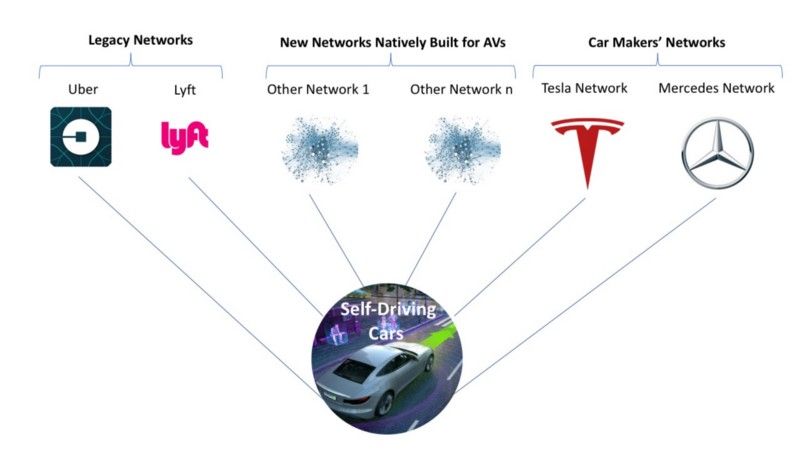

These dynamics will completely change when autonomous vehicles become widely available.

Once cars are fully autonomous, the defensibility of ride sharing networks will drop significantly. The value of their supply of drivers, that has been years in the making, will diminish drastically and, over time, will completely evaporate.

The power will shift from the networks to the car makers, private owners and fleet operators.

The shift will occur because the constraint of a human driver only being able to work for a couple of services, won’t exist anymore. An autonomous vehicle can register to thousands of different networks, listen simultaneously to requests from all of them, pick the optimal ride and tirelessly repeat the process.

The supply that is now locked in a duopoly will start spreading across more and more networks as they get created. Since the marginal cost to join and operate within an additional network will be close to zero, there will be no limit to how many networks a self-driving car could join. Consequently, autonomous vehicles will bypass the protective shield the old networks had.

In the meanwhile, Mercedes-Benz via Daimler signed an agreement with Uber to bring autonomous vehicles to its network and Waymo, the Alphabet car company, signed a partnership with Lyft.

Those agreements indicate that, self-driving car makers think they need existing networks, and existing networks think that they need self-driving cars.

But do they equally need each other?

Current networks don’t have a choice. If they don’t have self-driving cars, they will cease to exist.

Uber is already investing heavily in building their own autonomous vehicles. It sounds like the right way forward. However, it will lead to a fundamental change in its business model.

The model will shift from a marketplace, with strong network effects, to an asset ownership model with totally different economics and market dynamics. Imagine if AirBnB, because of some change in technology, had to own or build rooms. It could still be a viable business but it would be a completely different kind of business. It would be less about the network and more about maximizing assets’ utilization. That’s the business traditional hotels are in.

Uber’s strategy seems to be that owning both the network and the autonomous assets will create a more defensible position. It may be so in the beginning when operations are a hybrid of cars with human drivers and autonomous vehicles (AV). But as the share of AVs becomes dominant, Uber’s own network will become merely a channel among others.

If Uber keeps its self-driving cars locked in its own network, it would run a sub-optimal business. A company that owns bookable assets should maximize the utilization. Especially since an AV, like a hotel room, does not need to rest. The only required down time is for maintenance and cleaning.

Imagine if Hilton relied exclusively on their own booking central to get customers. Many rooms would be left empty.

So to maximize seats’ occupancy, should Uber register its own self-driving cars into other networks?

If they do, they would optimize the returns but at the same time diminish the value of their network.

If they don’t, other AV makers will register their cars into multiple ride sharing services and the defensibility of Uber’s network will be broken anyhow.

That is the dilemma they will face and it’s not clear what the best strategy to get out of it is.

Self-driving car makers, on the other hand, don’t need to rely exclusively on Uber and Lyft services. Those will be just initial channels.

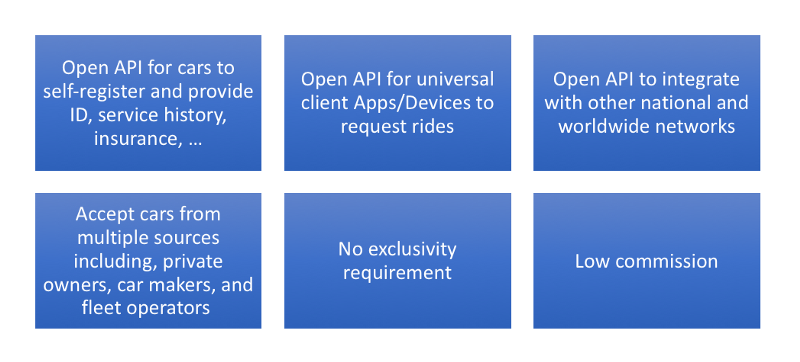

Actually, the most exciting ride-sharing networks haven’t been created yet. They will be the ones natively built for autonomous vehicles with tailored features:

With such an open platform, not only can AVs self-register to a large number of networks, but customers can use universal clients that will scan availabilities and rates across multiple services and select the optimal ride, without even realizing which underlying provider is delivering the trip.

The other technological evolution that will have a significant impact is the transition to decentralized and distributed architectures. This is covered in my previous post Blockchain and Smart Contracts Will Eat Online Marketplaces.

In our current pre-self-driving world, Uber and Lyft excelled with capabilities to:

- Convince a large number of drivers to join in every city.

- Run background checks.

- Deal with regulation across cities and countries.

- Classify drivers as employees/contractors depending on local labor laws.

- Support with car leases.

- Use carrot and stick management with bonuses and punishments when ratings go down.

None of these operations will be needed in the next generation networks.

Uber and Lyft would still have value during the early transition phase. But as the cost of a ride delivered by an autonomous vehicle will be much lower than the current rates, the transition to a fully autonomous supply will be extremely fast.

Once all human drivers retire, the current business model of Uber and Lyft will be tremendously challenged. The barrier to exit to existing customers will become low. At the same time, the barrier to entry for new networks, natively built for the self-driving world, will be small.

Network effects do provide an unfair advantage but over time, major technological evolutions can massively diminish their defensibility. Once the protective armor is gone, the value starts to leak out and the once strong businesses can become extremely vulnerable.

That does not necessarily mean those businesses will disappear. The question is, what should they do to literally reinvent themselves and ensure long term relevance?